MP2 Calculator One-Time: Quick Payout Estimate

The Pag-IBIG MP2 Savings Program is a great place to put your money. It offers a chance to grow your savings with just one investment. The MP2 Calculator One-Time makes it easy to see how much you could earn.

Just plug in how much you want to invest into the calculator. It will show you how much you could get back, thanks to Pag-IBIG MP2’s good dividend rates. This tool makes it simple to plan your financial future and make smart choices.

Key Takeaways

- An MP2 Savings one-time investment can be initiated with as little as P500.

- The upper limit for a one-time savings contribution is P500,000, ensuring avenues for both modest and substantial investments.

- When your one-time investment in MP2 Savings exceeds P100,000, proof of income is requisite.

- 70% of the Pag-IBIG Fund’s annual net income is allotted for dividend payouts to its members, highlighting the Fund’s member-centric approach.

- The MP2 Savings Program is a 5-year investment strategy, offering either full withdrawal after term completion or annual dividend payouts.

- A unique facet of Pag-IBIG MP2 Savings is the government guarantee, ensuring investment safety and peace of mind for members.

Understanding the MP2 Savings Program

The MP2 Savings Program is a great way to grow your money. It’s backed by the government and offers higher dividends than regular savings accounts. This makes it a strong choice for those looking to increase their financial portfolio.

Key Features of the MP2 Savings Program

The MP2 Savings Program is part of the Pag-IBIG Fund. It’s designed for members who want to save and grow their money. You only need PHP 500 to start, and there’s no limit to how much you can invest.

The program is tax-free, and your money is safe thanks to government guarantees. You can earn interest over 5 years without worrying about risks.

Eligibility for MP2 Savings Program

Many people can join the MP2 Savings Program. It’s open to current Pag-IBIG members, former members, and retirees. Even those who have returned to the Philippines can participate.

This wide range of eligibility means more people can earn tax-free dividends. It’s a great opportunity for those looking to save and grow their money.

Advantages of MP2 Over Regular Pag-IBIG Savings

The MP2 Savings Program offers more than regular Pag-IBIG Savings. You can choose to get your dividends annually or all at once when your savings mature. This flexibility is a big plus.

Since 2016, MP2 has consistently paid higher dividends than regular savings. Rates have always been above 7%. This makes MP2 a smart choice for those wanting to grow their money efficiently.

| Year | Pag-IBIG Regular Savings Dividend Rate | MP2 Dividend Rate |

|---|---|---|

| 2015 | 4.83% | 5.33% |

| 2016 | 6.93% | 7.43% |

| 2017 | 7.61% | 8.11% |

| 2018 | 6.91% | 7.41% |

| 2019 | 6.73% | 7.23% |

The MP2 Savings Program is a top choice for those seeking higher returns. It offers reliability, profitability, and flexibility. Whether you’re active, retired, or a former member, MP2 could be the key to growing your savings.

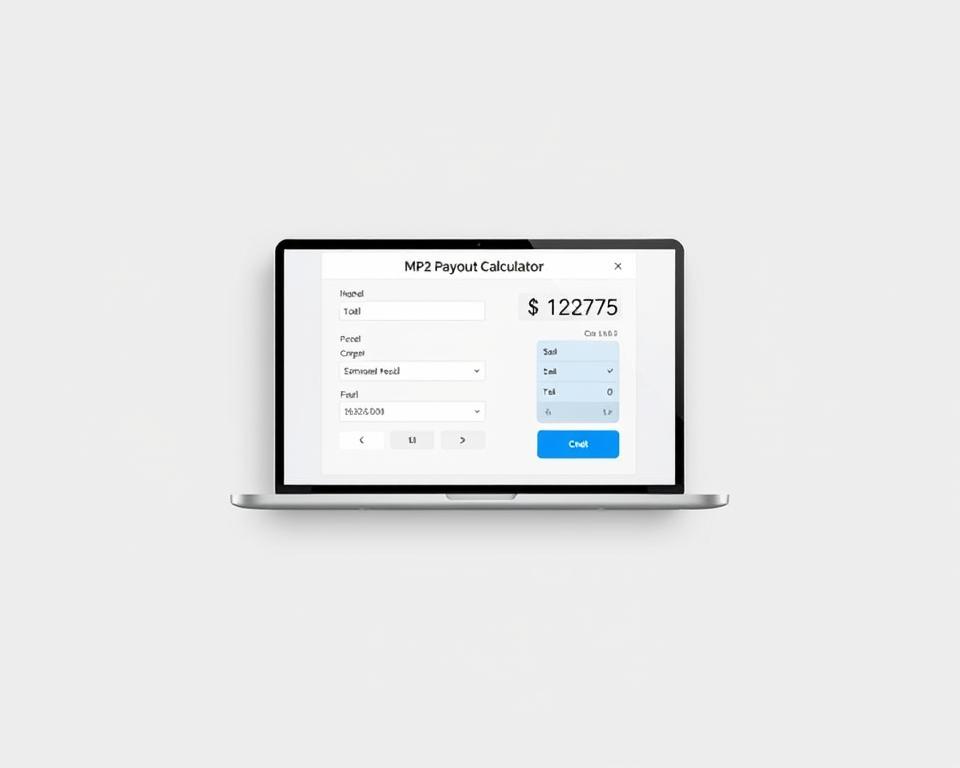

How to Use the MP2 Calculator One-Time for Quick Payout Estimate

Knowing your financial future is key, and the MP2 payout calculator is a great investment tool. It’s perfect for those who want to make a one-time contribution to their savings. This tool gives a detailed dividend projection, showing possible earnings and growth over time.

To use the MP2 payout calculator right, just enter how much you want to invest. For example, if you’re putting in Php 1,000,000, pick that option. Then, choose how long you want the calculator to project for, usually five years to match MP2 savings maturity.

Next, you’ll need to enter the expected dividend rate. Knowing the past rates, like 7.102% on average, helps guess future earnings better. After inputting all the info, the calculator shows your potential payout at the end of the term, combining your initial investment and expected dividends.

For instance, the table below shows how a one-time investment and dividends can grow:

| Year | Total Accumulated Value (TAV) | Dividends Earned | Growth Percentage |

|---|---|---|---|

| 1 | Php 1,075,000 | Php 75,000 | 7.5% |

| 5 | Php 1,435,629.33 | Php 435,629 | 43.6% |

This tool not only makes calculations easier but also helps in making better decisions. It shows how different dividend rates can affect your savings. Whether you’re looking at regular contributions or a one-time payment, or the best time to save, this calculator gives you a personalized view of your finances.

Remember, MP2 savings are flexible and offer tax benefits. Dividends are tax-free, and making a one-time contribution can greatly impact your financial planning. This ensures you make smart investment choices that fit your financial goals.

Maximizing Your Investment with One-Time MP2 Contribution

Investing in the MP2 Savings Program with a one-time payment is a smart move. It offers high dividend yields, unlike regular savings accounts. This means a big upfront payment can lead to more interest over five years.

Understanding the benefits of investing a lump sum in MP2 is key. A big deposit upfront can grow faster. This is where careful planning and knowledge of MP2 investments help. It ensures you make choices that fit your long-term financial goals.

Benefits of Lump Sum Investment in MP2

- Increased Dividend Earnings: MP2 dividends are often higher than regular bank savings. This means more returns over time.

- Tax Exemption: Dividends from MP2 investments are tax-free. This means your savings grow without tax.

- Compound Interest: A single deposit can grow a lot. This is because it earns interest on previous dividends over five years.

Strategies for One-Time Investment

- Timing the Market: Investing at the right time can increase your gains. Look for good economic conditions and stable dividend rates.

- Compliance with Investment Thresholds: For big investments over Php 500,000, follow Pag-IBIG’s rules. This includes using a manager’s check and showing proof of income.

- Understanding Withdrawal Terms: Know the rules for early withdrawal. This helps manage risks and avoid losing dividends.

A well-thought-out MP2 investment can help you reach financial goals. It also secures your future with five years of growth, backed by government support.

Dividend Rates and Their Impact on Your MP2 Savings

Knowing how dividend rates affect your MP2 earnings is key for those in the Pag-IBIG Fund’s MP2 savings program. These rates show the Pag-IBIG Fund performance and are given out yearly. At least 70% of this goes back to members, with more going to those who save more.

This makes saving more attractive, as it could lead to bigger dividends. It’s a great reason to save more to earn more.

Understanding Dividend Rates

Dividend rates for MP2 are more than just numbers; they show your share of profits. These rates can change based on the Fund’s success. This makes MP2 savings exciting and shows the value of saving for the long term.

Historical Dividend Rates and Future Projections

MP2’s dividend rates have shown strong returns over the years, hitting 8.11% in 2017. This history helps predict future earnings. It’s crucial for planning your financial future, especially for big investments.

Here’s a table showing how investments grow over five years at different contribution levels:

| Year | Monthly Contribution | Total Accumulated Value with 8.11% (2017 High) | Total Accumulated Value with 6.00% (2021 Rate) |

|---|---|---|---|

| 2020 | PHP 500 | PHP 6,243.75 | PHP 6,243.75 |

| 2021 | PHP 500 | PHP 13,297.62 (estimated) | PHP 12,955.78 |

| 2022 | PHP 500 | PHP 20,845.99 (estimated) | PHP 20,171.21 |

| 2023 | PHP 500 | PHP 28,940.76 (estimated) | PHP 27,927.81 |

| 2024 | PHP 500 | PHP 37,631.45 (estimated) | PHP 36,266.14 |

This table shows how investing at different rates can lead to big growth over time. It highlights the strong potential of MP2 savings, even in changing economic times.

MP2 Calculator One-Time

The MP2 calculator tool is a must-have for anyone thinking about investing in the Pag-IBIG MP2 savings program. It helps users estimate their savings by considering the initial amount, the time frame, and the dividend rates. This tool gives a quick look at how much you could earn over a certain period.

This tool is made to make it easier for MP2 Savings Program members to forecast their earnings. By trying out different scenarios, users can see how their contributions affect their dividends. For instance:

| Year | Dividend Rate | Estimated Earnings for PHP 25,000 One-Time Investment |

|---|---|---|

| 2021 | 6.00% | PHP 1,500 |

| 2022 | 7.03% | PHP 1,757.50 |

| 2023 | 7.05% | PHP 1,762.50 |

| 2024 | 7.10% | PHP 1,775 |

This tool helps users understand the financial benefits of their investments. It lets them make smart choices about their one-time investments. The MP2 calculator tool is essential for planning a secure financial future through the MP2 Savings Program.

Setting Up Your MP2 Account for a One-Time Investment

Starting your journey with a MP2 account for a one-time investment is exciting and important. A detailed guide and a list of needed documents are here to help you.

To open a MP2 account, you can visit the Virtual Pag-IBIG website or go to a Pag-IBIG Fund branch. The process is easy and secure. Here’s a step-by-step guide to get you started:

- Go to the official Pag-IBIG website and find the MP2 enrollment section.

- Download or fill out the MP2 enrollment form online.

- Get ready with your documents, like proof of income and ID, especially if your investment is over P500,000.00.

- Submit your form and documents online or at a Pag-IBIG branch.

- Wait for confirmation and start tracking your investment.

When opening your MP2 account, having the right documents is key. Here’s what you’ll need:

- Valid Identification (government-issued)

- Latest income statement

- Proof of previous and ongoing Pag-IBIG contributions

- Special Power of Attorney if applying through a representative (when necessary)

The enrollment form is crucial for starting your MP2 savings. Make sure all information is correct for a smooth process. Let’s look at the dividends and financial results of MP2 investments:

| Year | One-Time Payment Dividends | Monthly Payment Dividends |

|---|---|---|

| 1 | $1,800 | $0 |

| 2 | $1,908 | $700 |

| 3 | $2,022.48 | $850 |

| 4 | $2,143.83 | $1,000 |

| 5 | $2,272.46 | $1,200 |

Investing in a MP2 account can grow your money over time. You can choose one-time or ongoing deposits. Follow these steps carefully and understand your commitment. Open your MP2 account and start saving with promising returns.

Online Remittance and Payment Methods for MP2

Investing in the MP2 savings program is easier with online remittance. Many digital payment methods are now available. This makes managing your contributions to this savings program simpler than ever.

MP2 digital payments can be made through many platforms. You can use eWallet options like GCash, PayMaya, and Coins.ph for easy transactions. You can also make payments at Bayad Center and M. Lhuillier, giving you more options.

Keeping your transactions safe is very important. The Virtual Pag-IBIG portal is a secure place for making payments and checking your MP2 account. It uses top-notch encryption to protect your data, ensuring your online transactions are safe.

It’s also smart to update your passwords often and use two-factor authentication if you can. These steps help keep your personal info safe and add to the online transaction safety.

Thanks to these strong systems, MP2 program participants can contribute with confidence. They know their financial data is safe and their transactions are handled well. This digital approach makes contributing to MP2 easier and more appealing. It encourages more Filipinos to save and invest securely.

Growth Potential of MP2 Savings with One-Time Contributions

One-time contributions to the MP2 Savings Program offer a great mix of investment potential and ease. They provide a simple way to grow your wealth. The high dividend rates make the growth with big contributions stand out.

Looking at past results, the highest dividend rate was 8.11%. A single payment of Php 30,000 grew to Php 40,146.77 in five years. This includes Php 10,146.77 in dividends, showing how much you can earn.

Knowing these numbers is key to smart financial planning. It shows how one-time payments beat regular monthly ones. This is because big deposits earn more dividends over time.

| Contribution Type | Total Accumulated Value | Total Dividends Earned |

|---|---|---|

| One-Time Php 30,000 | Php 40,146.77 | Php 10,146.77 |

| Monthly Php 500 | Php 34,499.58 | Php 4,499.58 |

Choosing a big one-time payment can really boost your savings. It’s a smart move with the program’s good dividend rates. This way, you plan for the future without stress.

While both methods have benefits, one-time payments are better for growth. They help you reach your savings goals faster. This is good for your MP2 savings growth and investment potential.

Real-Life Examples of MP2 One-Time Payment Success Stories

The MP2 Savings program has changed lives for many. It offers a chance to make one-time payments and see real results. These stories show how MP2 can improve your finances and serve as examples for others.

Case Studies

An investor put in Php 30,000 once. After five years, they got Php 40,146.77, with Php 10,146.77 in dividends. This is a big win compared to other savings plans.

Another investor put in Php 30,000 and got Php 9,000 in dividends over five years. This shows MP2 works for different financial plans and goals.

| Investment Type | Total Accumulated Value | Total Dividends |

|---|---|---|

| One-time Payment – End Year Payout | Php 40,146.77 | Php 10,146.77 |

| One-time Payment – Annual Payout | Php 30,000.00 | Php 9,000.00 |

| Monthly Payment – Annual Payout | Php 34,350.00 | Php 4,350.00 |

Testimonials

Many investors love MP2 for its one-time payment option. They say it makes investing easy and boosts their earnings. These stories prove MP2 is reliable and effective, encouraging others to try it.

“Investing in MP2 was one of the best financial decisions I’ve made. The one-time payment option was hassle-free and the returns after five years were beyond my expectations.” – A satisfied MP2 investor

Investment Safety and Government Guarantee

The Pag-IBIG MP2 Savings Fund is known for its high yield and strong security. It offers a government guarantee that protects your savings. This makes it a great choice for growing your money with attractive dividend rates.

The MP2 program’s government guarantee means your investment is safe. This is especially important when the economy is uncertain. The Pag-IBIG Fund invests in stable areas like housing and government securities. This helps keep your savings safe from market ups and downs.

This safe investment environment is backed by strict rules. Even the biggest investments are well-supported. Here’s a look at the strong foundation of the MP2 Savings Program:

| Investment Criteria | Details |

|---|---|

| Minimum Investment | ₱500.00 |

| Maximum Investment | No upper limit |

| Term | 5 years mandatory lock-in period |

| Penalty for Early Withdrawal | 50% deduction on earned dividends |

| Guarantee on Principal | 100% protected and government guaranteed |

| Investment Avenue | 70% in housing and secure vehicles |

| Dividends | Tax-free, higher than Pag-IBIG I rates |

| Net Income (2020) | ₱31.18 billion |

| Dividend Rate (2020) | 6.12% |

Together, these features make MP2 a safe and smart choice for your savings. It’s a secure way to grow your money with the backing of the government.

Conclusion

The Pag-IBIG MP2 program offers a great mix of high returns and safety. It gives back at least 70% of Pag-IBIG’s profits as dividends. In 2021, investors saw a 6.00% dividend rate, showing strong performance.

This program is reliable for long-term financial planning. It has a five-year maturity period. This makes it a solid choice for investors.

Even with economic ups and downs, Pag-IBIG Fund keeps its dividend rates steady. This shows its dedication to helping its members grow. Plus, the dividends are tax-free, making it even more appealing.

Investing in MP2 is easy, with a minimum of Php 500 monthly. You can pay through salary deductions or in person. This makes it easy for anyone to join.

The MP2 program has many benefits. It’s flexible, allowing you to open many accounts. It’s also backed by the government, offering peace of mind.

With the MP2 Calculator One-Time, you can predict your returns. This helps you plan your investments wisely. The Pag-IBIG MP2 Savings Program is a strong choice for reaching your financial goals.

FAQ

What is the MP2 Savings Program?

Who is eligible to participate in the MP2 Savings Program?

How does the MP2 Savings Program compare to regular Pag-IBIG Savings?

How do I use the MP2 Calculator One-Time to estimate my potential payout?

What are the benefits of making a lump sum investment in the MP2 Savings Program?

Can strategic timing impact my one-time investment in MP2?

How are dividend rates for the MP2 Savings Program determined?

What historical dividend rates can tell us about the MP2 Program?

What steps are involved in opening an MP2 Savings account?

What documents are required to open an MP2 account?

What are my options for remitting payments to my MP2 Savings account?

How can I ensure my online transactions for MP2 Savings are secure?

Are there any case studies available that showcase the benefits of one-time investments in MP2?

How is my MP2 investment protected?

What role do government guarantees play in the MP2 Savings Program?

Source Links

- MP2 Savings Calculator | Calculate Your Pag-IBIG MP2 Savings Easily

- Pag-IBIG MP2 Calculator | MP2 Dividend Rates 2025. MP2 Savings Calculator

- FAQs | Virtual Pag-IBIG

- HOW TO INVEST IN PAG-IBIG MP2: COMPLETE GUIDE

- [Ultimate Guide] How to Invest in Pag-IBIG MP2 Savings Program

- How to compute Pag-ibig MP2 dividends: An Easy to Follow Guide

- How to Maximize Pag-ibig MP2: Monthly, Yearly, or One-time?

- How To Invest in Pag IBIG MP2 Program: An Ultimate Guide – FilipiKnow

- Pag-IBIG MP2 Calculator – See How Your Money Can Grow

- Pagibig MP2 Savings: All You Need to Know to Invest in 2024

- MP2 Savings & Pag-IBIG – Grow your wealth in the Philippines

- 5 Strategies to Get the Most out of Pag-IBIG MP2

- Pag-IBIG MP2 Calculator 2025 – How Much Can I Save?

- MP2 Savings Program: Earn Dividends of Up To 6%-7% P.A.

- Pag-IBIG MP2 Calculator: An Easy Way to Strategize Your Investment

- A Comprehensive Guide on the Pag-IBIG MP2 Program | Lamudi

- How to Enroll to Pag-IBIG MP2 Online | Lumina Homes

- Save More with Pag-IBIG MP2 Savings Program

- Modified Pag-IBIG II (MP2) – A Guide – Diary Ni Gracia

- Virtual Pag-IBIG

- HR/Investment Talk: Where is the BEST, Safest Place to Put Your Hard-Earned Money (Answer: Pag-IBIG MP2 Savings Fund)? – Tina in Manila

- Pag-IBIG Contribution Calculator – PagibigCalculator